Traditional retail has faced major headwinds over the past two decades, first driven by the rise of e-commerce and then accelerated by the COVID-19 pandemic. As online shopping grew, physical retailers struggled to compete, leading to widespread closures of department stores, malls, and independent shops. The pandemic dealt a final blow to many, with lockdowns and shifting consumer habits forcing major chains like J.Crew, Neiman Marcus, and JCPenney into bankruptcy, while countless small businesses shut their doors.

Despite these challenges, recent trends suggest a rebound in physical retail. Some brands are expanding, consumer interest in in-person shopping is rising, and independent retailers are re-embracing storefronts. The recent holiday shopping season reinforced this trend, with nearly half of U.S. shoppers saying they would shop in-store.

However, retail demand varies across the U.S., with some regions experiencing a surge in new businesses while others continue to see declines. This analysis by Printastic, a leading provider of custom signs and banners for businesses, highlights the states and cities with the fastest-growing retail sectors, offering insight into where demand for in-person shopping is rising—and where it continues to struggle.

U.S. Retail Establishment & Employment Growth

Source: Printastic analysis of U.S. Bureau of Labor Statistics data

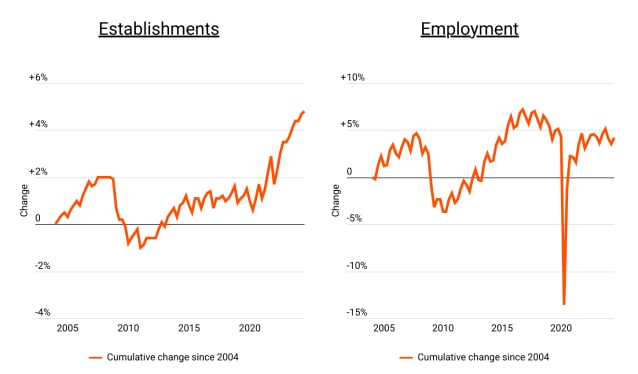

Since 2004, retail establishment growth has lagged behind the broader economy. As of mid-2024, the total number of U.S. businesses has grown by 49.4% over that 20 year period, while retail establishments have increased by just 4.8%.

Retail expansion was steady—but below average—until 2008, when the Great Recession stalled growth and retail employment fell. The sector remained sluggish through the 2010s, while total business growth accelerated. The COVID-19 pandemic in 2020 triggered a sharp drop in retail employment as stores laid off workers, though the total number of retail establishments was not as affected.

However, as the economy reopened post-COVID and demand for in-person shopping grew, the retail sector experienced its most significant expansion in the past 20 years, adding over 38,000 stores and more than 870,000 workers nationwide.

America's Largest Retail Sectors

Source: Printastic analysis of U.S. Bureau of Labor Statistics data

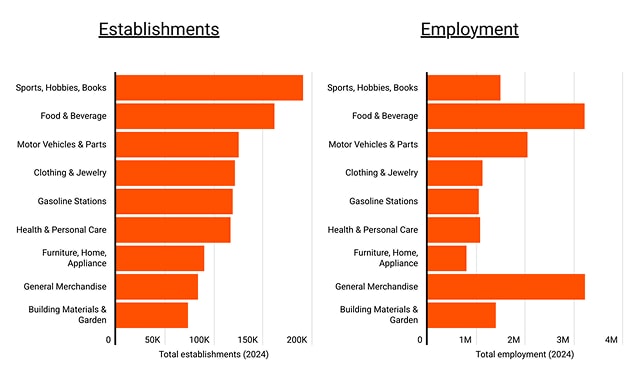

As of 2024, the sports, hobbies, and books sector has the most retail establishments, with 190,490 locations across the U.S., yet it employs a relatively modest 1.49 million workers. This category includes bookstores, sporting goods shops, musical instrument retailers, and specialty hobby stores. Unlike big-box retailers, these businesses are often smaller, independently owned shops with fewer employees per location.

Other sectors with a high number of establishments include food and beverage stores (161,346 locations, 3.21 million employees), which consist of supermarkets, specialty grocery stores, and liquor stores, as well as motor vehicles and parts retailers (124,889 locations, 2.04 million employees), which encompass car dealerships, auto parts stores, and service shops. Clothing and jewelry stores (121,029 locations, 1.12 million employees) also make up a large portion of the retail landscape, covering everything from boutique fashion retailers to major apparel chains.

Some industries operate fewer but larger-format stores. General merchandise retailers (83,379 locations, 3.22 million employees), which include big-box chains like Walmart and Target, employ the highest number of workers in the industry despite having fewer locations. Similarly, building materials and garden supply stores (73,195 locations, 1.39 million employees), such as Home Depot, Lowe's, and independent hardware stores, tend to require large retail spaces but operate fewer locations than other industries.

The data highlights how establishment numbers don't correlate strongly with employment levels. Large-scale retailers like general merchandise and food and beverage stores employ significantly more workers than other industries with similar establishment counts.

learn more

High-quality custom signs and banners can help a small business improve visibility and branding dramatically. With fast production and shipping times, Printastic offers an affordable and efficient solution for businesses looking to enhance their marketing efforts. Learn more about Printastic's 100% American-made vinyl banners today.

Retail Business Growth by State & Metro

Source: Printastic analysis of U.S. Bureau of Labor Statistics data

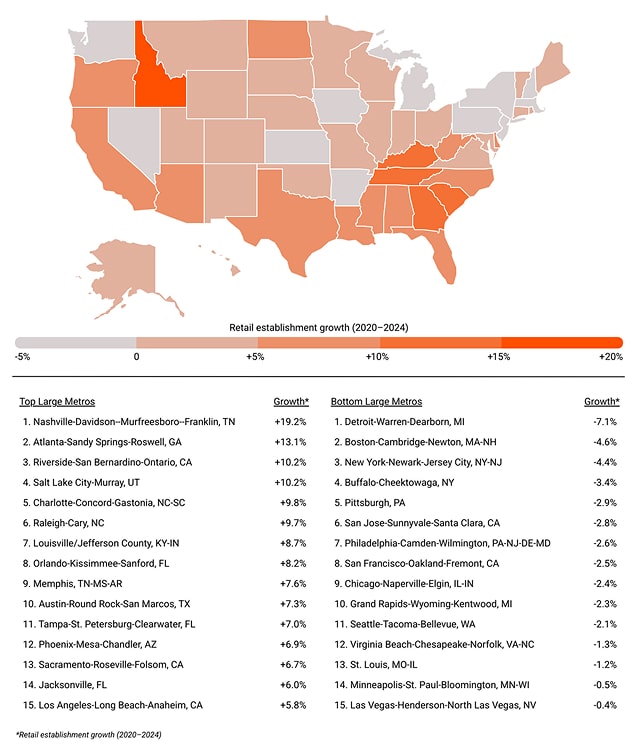

Retail business growth over the past four years has been strongest in the Southeastern and Western U.S., with Idaho (+18.8%) leading all states in retail establishment growth from 2020 to 2024. Other states seeing double-digit growth include Tennessee (+14.5%), Georgia (+12.5%), South Carolina (+12.4%), and Kentucky (+10.4%). These states have benefited from population growth, rising consumer demand, and favorable business climates that have encouraged retail expansion.

Conversely, several states in the Northeast and Midwest have seen retail contraction. New York (-4.1%), Michigan (-3.5%), Massachusetts (-3.4%), and Iowa (-3.2%) have all experienced declines in retail establishments since 2020, likely due to higher operating costs, population shifts, and competition from e-commerce.

Among the nation's 50 largest metropolitan areas, Nashville, TN (+19.2%) saw the highest retail business growth, reflecting the city's rapid economic expansion and strong consumer market. Other high-growth metros include Atlanta, GA (+13.1%); Riverside, CA (+10.2%); Salt Lake City, UT (+10.2%); and Charlotte, NC (+9.8%), all of which have seen influxes of residents and rising demand for local retail.

On the other end, Detroit, MI (-7.1%); Boston, MA (-4.6%); and New York City (-4.4%) saw some of the steepest losses in retail establishments, mirroring statewide trends. The data highlights the uneven recovery of retail since the COVID-19 pandemic, with the strongest growth concentrated in the Southeast and Sun Belt regions, while legacy retail markets in the Northeast and Midwest continue to struggle.

Continue below for complete results for all 50 states and 375 metropolitan areas.

Methodology

This analysis is based on data from the U.S. Bureau of Labor Statistics Quarterly Census of Employment and Wages (QCEW). To identify locations with the most retail business growth, researchers at Printastic calculated the percentage change in the number of retail business establishments between 2020 and 2024. Because Q4 2024 data has not yet been released, data from the first three quarters of each year was averaged.

In cases where two locations experienced the same percentage increase in retail establishments, the location with the larger percentage increase in retail employment over the same period was ranked higher.

Only metro areas with complete data for all six quarters were included. Connecticut metros were excluded due to county boundary changes. Metros were categorized into three cohorts based on total retail employment:

- Small metros: less than 10,000 employees

- Midsize metros: 10,000–49,999 employees

- Large metros: 50,000+ employees